‘Feel-good factor, meet hard cash’, says Arjan Schimmel in the second of our WXO Member Spotlight series.

For decades, customer experience has been championed as the ultimate competitive differentiator. In practice, however, it is often treated as a well-meaning expense, not a proven investment. This disconnect is symptomatic of a peculiar linguistic divide in companies, in which CX teams talk about “satisfaction” and “advocacy”, while the financial leadership listens out for “EBITDA” and “ROI”.

This divide becomes an existential threat during budget season. Corporate capital allocation is a zero-sum game. A CX initiative that promises a 10-point increase in NPS must compete directly with a warehouse automation project that promises a 19% Internal Rate of Return (IRR). The CX project is not just rejected; it is disqualified for failing to meet the minimum threshold of a serious capital request.

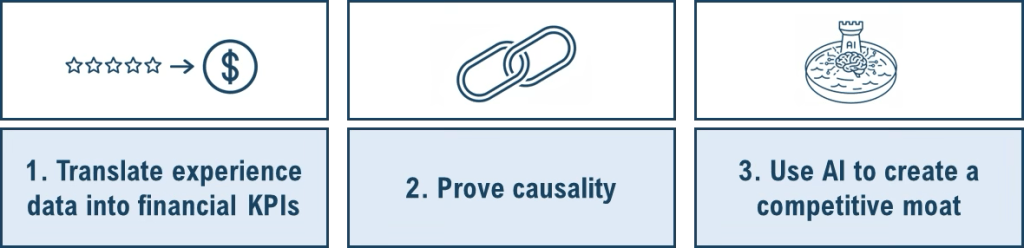

This document outlines a three-step framework to address this gap.

Before we look at the framework, it is helpful to gain an understanding of what is causing this linguistic divide.

The ignored evidence

The connection between customer experience and financial performance is both clear and well-documented, with numerous studies showing that companies focused on customer experience consistently outperform their competitors. For example, McKinsey research found that CX leaders achieve more than double the revenue growth of their laggard competitors. Forrester data concurs, showing CX leaders grow revenue 80% faster and, critically, command a 16% price premium, which flows directly to the profit margin.

A 5% increase in customer retention has been shown to boost profits by 25% to 95%. Research from the American Marketing Association directly links improving customer satisfaction to growth in sales, margins, and EBITDA. Another study quantified that a one-point rise in satisfaction can lead to a $130 million decrease in future selling costs.

The evidence is there, but CX leaders clearly struggle to articulate the financial value generated by experience. The consequences of this failure are now acute. A 2024 Deloitte Digital study found that one of the top 5 challenges of CX leaders is “making the investment case for experience.”

The root of the problem: misunderstood metrics

The Net Promoter Score (NPS), while loved by many CEOs for its simplicity, is viewed with deep suspicion by finance as well as operations teams. From their perspective, NPS is a fundamentally flawed metric. It is never audited, its inputs are opaque and the score is easily influenced by external factors. What makes that suspicion even more poignant is that they are right.

This is because NPS is a valuable method, badly misapplied as a KPI. Its intended purpose was never to be a static performance target, but to enable a dynamic process of continuous improvement. The score is only the start of that process, which requires follow-up with individual customers (called “closing the loop”) to turn feedback into action and build a stronger relationship. This process is more than just collecting data; it is about having a direct conversation with the customer to understand their concerns, offer solutions, and build loyalty by demonstrating that their feedback is valued and acted upon.

Somehow, that message never landed. In most businesses, the score is simply used as a performance target.

Even Fred Reichheld, the creator of NPS, indicates that it is used incorrectly 90% of the time. As he put it, “The instant NPS becomes a target, it is no longer trustworthy as a measuring tool. When employees feel pressure to secure an imposed number, they lose sight of the purpose of NPS, which is to learn how to improve the customer experience.”

CSAT faces the same issue. Even though it was intended as “real-time temperature check” on specific moments, it is widely misapplied as a corporate or even personal performance indicator. As Rob Markey, co-creator of NPS, highlighted in an article as early as 2011, “When you begin to quantify customer feedback, employees and managers may not know how to move them in the right direction.”

This reveals the critical translation error. Customer Experience departments need to use customer feedback for its intended purpose: to find and drive operational improvements that ultimately affect the customers’ experience. But to track performance and justify investment, they must speak in the language of operational inputs and financial outcomes. This requires using metrics that can be directly controlled and are a true reflection of performance.

The way forward

The onus, therefore, is on CX leaders to become translators, to build a bridge from sentiment to profit and loss account. It requires a methodical approach that translates experiences into the stark language of finance: revenue, cost, and profit.

The sections below outline a three-step framework that provides the methodology to do so:

1. Translate experience data into financial KPIs

The first step in this translation is to stop measuring mere satisfaction and start measuring the economic value of a customer’s time and effort. As the authors Joe Pine and Jim Gilmore have long argued, businesses compete for their customers’ time, attention, and money. They distinguish between two value propositions:

- “Time well-saved” applies when customers seek friction-free low-cost access to a product or service.

- “Time well-spent” applies when customers seek to have an experience or transformation.

In the experience economy, this “Time well-spent” model is paramount, as you are effectively charging for the time customers spend with you. Here, the financial link is simple: a better experience means people spend more time, generating more revenue. However, most businesses still operate in the “time well-saved” world, where the link must be proven with hard data. This requires moving beyond correlations to establish quantifiable financial connections.

- Focus on operational metrics, not lagging indicators. Managing a business on sentiment scores like NPS is like trying to steer a ship by watching its wake. These metrics are lagging indicators; they tell you where you have been, not where you are going. True financial return comes not from what customers say after the fact, but from controlling the operational inputs that influence what they do in the moment. This reframes the objective entirely. Instead of chasing an NPS target, the goal becomes “reduce order error rates by 10%” or “improve first-contact resolution from 70% to 80%”. These are direct operational levers with financial results. A lower error rate means direct savings in returns and support, while higher first-contact resolution protects revenue by reducing customer churn.

- Sandbox improvements. Rather than attempt to boil the ocean by improving everything at once, a more credible approach is to isolate a single, high-friction customer touchpoint with a clear financial impact, such as high cart abandonment during checkout. A combination of qualitative feedback and quantitative data can pinpoint the precise moment of failure causing the drop-off. A targeted fix can then be deployed. By measuring the lift in conversion or spend against a control group, the exact amount of recovered revenue can be calculated. This transforms a vague goal like “improve NPS by 5 points” into a tangible, bankable return.

- Conduct A/B tests. This is the gold standard for systematically testing, validating, and scaling what works, and mitigating the risk of large, unproven investments. Implement a change, such as a new site layout or staff training programme, in a set of test locations while leaving a set of similar control locations unchanged. After a set period, compare the aggregate financial performance (e.g. total sales, average transaction size, footfall) between the two groups. The difference is the financial lift from the improvement, providing hard-nosed IRR.

2. Prove causality

To ensure that capital is not being allocated based on flawed or biased analysis, evidence must be provided. The conversation needs to move beyond simple correlation (e.g. “our NPS went up and so did sales”) to proof of causation.

While a controlled A/B test is the gold standard for proving causality, such perfect test conditions are often a luxury in complex environments. When a clean test is not feasible, robust analytical methods can isolate an initiative’s impact:

- Trend impact analysis. This approach (also known as Interrupted Time Series) compares a business’s performance to itself over time. A predictive model is trained on aggregate historical data, such as monthly revenue or churn rate, to learn the business’s normal rhythm, accounting for established trends and seasonality. This baseline is then projected forward, creating a “what if” scenario of what would have happened without the CX initiative. The financial impact is the difference between the actual results and this forecast, quantifying the return even in complex environments.

- Threshold design. This method (or Regression Discontinuity Design) is powerful when a specific rule determines who receives a treatment. Imagine a loyalty programme that grants higher status to customers once they spend over $500. Without the programme’s effect, the behaviour of customers who spend $505 should be nearly identical to those who spend $495. Any sharp, sudden jump in their spending or visit frequency at that exact cut-off point can be confidently attributed to the initiative, providing strong causal evidence without needing a control group.

3. Use AI to create a competitive moat

The ultimate goal is to shift from justifying past spending to guiding future investment. This is where AI-powered platforms can build a genuine competitive moat. They can analyse vast, disparate datasets (such as transaction records, support interactions, social media sentiment) to uncover patterns invisible to typical analysis.

- Secure the customer base. A predictable, low-churn customer base is a balance-sheet asset that guarantees future revenue streams and increases the company’s valuation. Predictive analytics allow firms to identify at-risk customers before they decide to leave. AI models can analyse subtle signals, such as declines in product usage or changes in support interactions, to calculate a churn probability score for every customer in real time. This enables targeted interventions, from personalised offers to proactive support, which directly protect revenue.

- Drive customer lifetime value. To maximise the value of each customer, offerings must be differentiated based on individual preferences. While traditional models use historical averages, AI and machine learning algorithms can predict a customer’s future value with remarkable precision. This allows for a dynamic allocation of resources: investing in premium services to retain high-value customers, while deploying targeted experiences to cultivate the relationship with other customers. This transforms CLV from a static label into a dynamic playbook for growth.

From cost centre to profit engine

For decades, customer-centricity has been championed with subjective scores, creating an ambiguity that has seen its value systematically challenged and its budget cut. That era is ending. This framework provides the linguistic bridge from customer “happiness” to hard cash.

By translating sentiment into operational metrics, proving causation with data, and using AI to predict financial outcomes, the linguistic divide is closed. This is how customer experience sheds its reputation as a well-intentioned cost centre and earns its keep, not as a supplicant asking for budget, but as a strategic, profit-generating engine that delivers sustainable shareholder value.

WXO Member Spotlight

About the author: Arjan Schimmel

Arjan is an innovator who works with top teams to create transformational experiences

Working with top teams to create transformational experiences – across industries. Worked with Pizza Hut, McDonald’s, Asda, Majid Al Futtaim, ROSHN, Tawuniya and many others.

With Majid Al Futtaim and ROSHN he led the development of strategies to transform quality of life for residents in living communities.

With Pizza Hut Restaurants he implemented a shift in focus when serving customers, which drove an improvement in the dining experience as well as business results.

Based on his 25 years+ experience as leaders as well as strategic consultant he is able to quickly dig below the surface, identify the main drivers for success, and make them happen.