Experience strategist Arjan Schimmel on why insurers should be focusing on their customers’ feelings and turning insurance into an experience to add value.

This article explores:

- How insurance providers can be everyday superheroes

- Why the industry has lost its way and how to fix it

- How insurance can be turned into an experience to add value

- How prevention is better than cure when it comes to insurance

If you ever find yourself at a party locked in a conversation you’re desperate to get out of, try the following: tell them you work in insurance. It’s a guaranteed conversation killer. Talking about insurance is about as sexy as swapping notes about a rainy weekend of trainspotting.

Why is that though? Insurance has all the ingredients of a job that has superhero status. Insurance, after all, is about providing a safety net for people in distress. Had an accident? The insurer will fix it. Need to see a doctor? The insurer will cover it. Surely working in that industry should be one of the coolest, most fulfilling jobs in the world?

That’s the theory. The reality looks quite different. Just imagine Batman responding to his call-sign by asking the commissioner to submit evidence that the call for help is genuine, so that Robin can assess whether the distress call is covered by the call-out policy and what type of response that policy stipulates. But no worries: they will get back to you in the next 24 hours.

Adding Value

The insurance industry has completely lost sight of the job that they are supposed to do for their customers. Instead of looking after customers and providing a safety net, the industry has become so inward-focused that their interests have become diametrically opposed to those of their customers. For all the marketing communications about customer centricity and great experiences, what really matters is loss ratio.

I’m not saying that profit is a dirty word, quite the opposite. But for profits to be sustainable, the customers who pay the premiums need to feel that they get value in return. And that’s where the problem lies for insurers. Just look at customer churn rates across the market. Consumers (and businesses) shop around for the best deal, in the same way that they choose a mobile operator or utility. That is a sign that the product has become a commodity – a basic necessity with little or no distinguishing qualities between competitors, other than price.

Focusing On Feelings

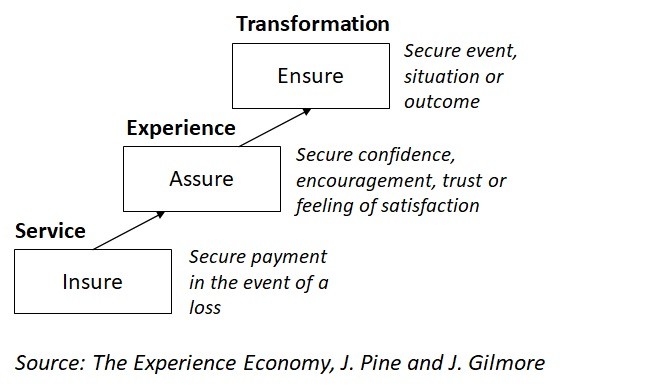

But it can be different. In their book The Experience Economy, Joe Pine and Jim Gilmore set out an interesting model for the different types of economic offerings that insurers could offer.

The most basic economic offering is insurance as a service. This is what is typical at the moment: conditional payment to compensate for an unexpected loss. Whether they like it or not, the players in this field offer a commodity in the eyes of their customers.

The next level is to turn insurance into an experience. Beyond just paying out, also focus on the feelings of the customers. Unfortunate events are typically cause for concern or even distress, so why not help the victims cope with the situation emotionally as well as financially? That may seem common sense, but the current opaque rules and slow procedures actually cause emotional distress.

The third and final level of economic offering is transformation. Instead of reacting to negative situations, why not ensure that customers have fewer problems in the first place? Suddenly the proposition is very different. Instead of waiting for bad things to happen, proactively help customers ensure that they don’t.

Transforming For Profit

Each level provides an increased amount of perceived value for the customer. And herein lies the beauty: when well executed, the amount of additional perceived value for the customer can significantly outstrip the actual cost to the insurer. In the medium term costs for insurance as a transformation should even be less than before, simply because healthier, safer, more secure customers automatically lead to a reduction in loss incidence.

The good news is that many insurers have cottoned on to this idea and have started communicating about it enthusiastically. The bad news is that the message hasn’t really landed within business operations, thus creating a chasm between theory and practice. It’s time for insurers to start practising what they preach.

To get more insights from experts in the Experience Economy – and to be the first to know about our membership programme, events and more – apply to join the WXO community now.