If we asked you to name the biggest immersive success story of the 2020s, we’re pretty sure that Meow Wolf would be one of the first – if not THE first – names on your lips.

The collective has launched exhibits in Las Vegas and Denver. Sold over 300,000 presale tickets for Convergence Station. Been talked about everywhere from The New York Times to The Economist to Forbes.

They’re making money, raising funds, and providing work to hundreds of artists, producers and creatives. Oh, and redefining what immersive art means along the way, bringing interactive and psychedelic experiences to the masses.

But this trifecta of creative, critical and commercial success had to start somewhere. How did Meow Wolf go from sleeping in their cars and dreaming of changing the art world, to actually doing it? How did they avoid flaming or burning out before they reached their potential? And perhaps most crucially of all, how did they convince investors to go along for the ride?

Fortunately for our experience experts (and you!), for our latest Campfire we welcomed the person with all these answers: Alice Loy, Meow Wolf’s first institutional investor and the CEO & Co-Founder of Creative Startups, the world’s leading accelerator for creative entrepreneurs.

Founded 15 years ago with a mission to bring forward “the weird and the wonderful”, Creative Startups is based in Santa Fe, New Mexico – one of the top art markets in the world, but also one that was moving towards a more staid and less profitable model. Upon launch, their aim was to provide disruptive tools to help creatives working in the disruptive environment of a new economy, where Disney was in decline and Art Basel the hot ticket.

In 2011, Meow Wolf had raised $3,481 to support their project The Due Return on Kickstarter. They charged $10 a ticket and ended up welcoming 25,000 visitors – which in a town of 125,000, wasn’t too shabby.

This shifted their thinking towards seeing what they did as a viable business and not just a creative idea – but they found it challenging to convince investors the same. Those they encountered were tied to a more cookie-cutter ideal of what an entrepreneur or profitable business looked like, pigeonholing them as a non-profit.

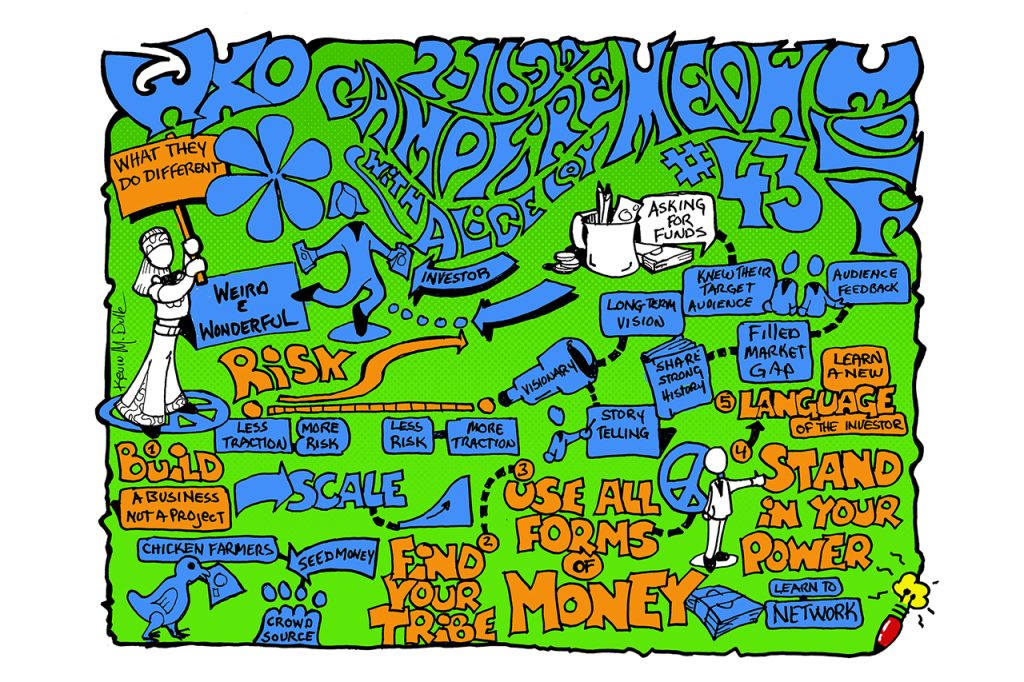

So in 2014, Meow Wolf signed up for Creative Startups’ first accelerator. How did they get from there to where they are now? Loy took us through their investment journey, explaining what creative businesses looking to scale up their ambitions can adapt from their story in the hopes of capturing some of the same success. Scroll down to read the full report, and view Loy’s presentation here:

1. Be Visionary And Dogged

Loy kicked things off by showing the four-minute video Meow Wolf’s founders recorded in 2014 as part of their application to Creative Startups, in which they explained their business using phrases such as:

“The larger the experience, the better.”

“We want to be family friendly, as in Santa Fe there’s not that much for children or families to do.”

“We create story worlds where you as the viewer aren’t separate from the art: you play an active role in creating a story for yourself.”

“People pay repeatedly to enter the exhibit.”

“We have skills in every media of art – we’re builders, painters, interactive, video, digital…”

Our Campfire were struck by how much Meow Wolf had already become oriented around the right ideas at this early stage.

“They recognised their own competencies and gaps.”

Steve Usher

“They used the word ‘immersive’ a lot. It was audience-generated. And they had a democratic approach – they wanted to create a playground for everyone.”

Stefan Weil

“They had traction – people were coming through, paying, and repeating, and they were launching in different cities. They also illustrated that the bigger the events they created, the more successful they were – giving them more reason to continue and make it bigger.”

James Wallman

One of the key reasons Meow Wolf were able to shift to their current success is that they’ve been very consistent with understanding their vision and their place in both the art world and their target markets, such as families. This gave them a cohesive narrative from the get-go, and helped them to stay obsessed with customer feedback to evolve and adapt.

2. Understand Your Investor’s Perspective

To get investment, you don’t only need to understand what you stand for – you need to understand where your investor is coming from, too. Although storytelling is important, it might be a different kind to what you’re used to.

“It’s easy to get wrapped up in your excitement about your project and think that your excitement will be contagious, but the financial buyers are seeking a different story than the world-changing creative one that gets you excited. You need to convey your story to fit their very specific financial interests.”

Ron Graham

Loy asked our Campfire if they had encountered any differences in perspective between them and the investors they met.

“We were talking about how we were going to change the world, and they were talking about how we were going to be profitable relatively quickly. We had to show the change we were going to make for the world was somehow going to be paid for by the world!”

John Connors

“The question of stickiness – they might be interested in launching a concept, but wanted to know as you evolve, how are you going to show a lifecycle over the long term? We might get a quick ROI, but what will be the long term?”

Louis Alfieri

“That it’s not just a vision of changing the world, but how can you scale that vision? What makes you different that no-one can replicate, what’s your total addressable market, and how quickly can you scale it?”

Max Lenderman

3. Know Where You Stand On The Risk S-Curve

One of the key ways to answer these questions is to understand how investors think about risk. Angel investors might be really visionary about where they want the company to go, but they also understand that they have to make a return.

“It’s even more true if you’re a venture capitalist and you are managing other people’s money. You have a fiduciary responsibility and a layer of regulations that you have to adhere to. And so the way that most investors think about any sort of investment is risk or less risk.”

Alice Loy

When you start out as an entrepreneur, you’re really risky not only because you don’t have traction, but because you don’t have the capacity to shift when the market shifts – for a pandemic, for example.

At the beginning, you therefore need investors who are less interested in the financials and more interested in the vision and the likelihood of it becoming profitable. As you move up this S curve of risk, you start working with investors who only really care about ROI.

“Understanding where you are in this trajectory is really important, because otherwise you’ll waste time talking to people who are never going to invest in you because you’re just not in their risk space.”

Alice Loy

Harsh Manrao has a way of looking at creating value in a company that maps onto this risk trajectory.

“The whole idea of a company is that it should multiply value. This happens in three stages:

1) When you create value, i.e. the product

2) When you enhance value, i.e. the brand

3) When you extract value, i.e. scaling

If you’ve only got investors who are interested in extracting value when you’re creating value, that won’t work. Or if you’re enhancing, you need people who understand brands.”

Harsh Manrao

4. Build A Company, Not A Project

When it comes to Alfieri’s question of “stickiness”, Loy has one key piece of advice: build a company, not a project.

In the US, the average venture investment takes 11 years to exit – longer than most marriages! Investors are in it for the long haul, because over that 11 years they need to make 3.5x money

“When I hear sticky, I hear scale. What was interesting to the investors who came along in series AB with Meow Wolf was not just how big they were, but also the relatively little amount of investment it took to scale the revenues beyond the costs.

So it’s really important to break down what people mean when they say scale. They’re not talking about millions of people. That may not be relevant to your business. What they are talking about is the scale of the difference between the revenues that you grow and how much it costs to grow those revenues.”

Alice Loy

5. Find Your Tribe

Being able to understand where your investors are coming from means you’ll be able to focus on those that align with your vision and are actually likely to invest in your company.

The first source of funding for any start-up is likely to be family or friends, personal credit, crowdfunding (like Kickstarter), loans, or revenue share. The same was true for Meow Wolf – they did a crowdfunding campaign, got loans from their families and did revenue share, and weren’t able to talk to significant investors until they had moved further up the investment s-curve and were seen as less risky, at least three years after they had started.

Revenue share is also overlooked as a type of investment, but is starting to become more prevalent. It means that you’re aligned around revenue rather than growth, which can mean different things to different investors. For Meow Wolf, growth meant new locations – but they needed to raise $100m for each new location. This meant the founders had to sell some of their stock – and even though they still became successful and made money, they could have made more under a different structure.

The next stage will be investors who aren’t investing for the money, but for the story. In Meow Wolf’s case, the first 20 investors were people who were very strategic and loved their story of making Santa Fe relevant again in the global art market. Three of these even told Loy that they didn’t think they’d see their money again, but loved the vision so much they were happy to invest.

Showing your value to the wider community can be a powerful part of your story, whether that be local politicians or real estate investors. A successful experience can bring in visitors and revitalise a whole community – hotels have more guests, restaurants have more diners, and money and jobs flow into the community as a result. Take Moment Factory’s Foresta Lumina, which increased visitors to the park from 10k to 300k and resulted in hotels being built at the park’s entrance, or what happened in Bilbao when the Guggenheim gallery opened.

(Side note: the WXO is currently working on a State of the Experience Economy report that puts a number on the valuation of different sectors of the Experience Economy, in part to help experience creators convince investors of the value of what they do. Stay tuned for details!)

These kind of investors can be hard to find, as they’re not professional angel investors – but they might come from a surprising source.

“The most overlooked source of angel investors right now for creatives is successful creatives. You do not have to make the argument to them. They get it. I have more success now introducing creatives to creatives who immediately understand the value so they can just focus on the vision.”

Alice Loy

And these investors aren’t only valuable in their own right: they also connect you with other potential sources of support.

“The thing that then happens is that those trusted advisors attract more trusted investors. The biggest thing that Creative Startups brought to Meow Wolf was not the money: it was that people trust us.”

Alice Loy

The last stage will be venture investors who are looking to maximise their return as quickly as possible. They care about ROI and their customers are their limited partners, not you. At this stage, it’s all about the finances.

6. Stand In Your Power

Getting to the people you need to in order to raise money means going hard and standing in your power. This is something Loy saw first hard with Vince Kadlubek, who was clear that he wanted to raise money, and unafraid of identifying and pursuing the people who could get him there.

“Stand in your power: what you are doing is worth it, as long as you’re building a company and not a project. People are interested in creative businesses.”

Alice Loy

Having someone in your team who is happy to do this is crucial to raising that investment.

“Sequoia, a huge venture capital firm, recently did a study analyzing all of their entrepreneurs and the one common thing that they all had was being voracious networkers: getting to the person who was the decision maker with the money. So if you’re not that person, add someone to your team who loves to close, because that’s what it takes to raise that amount of money.”

Alice Loy

7. Learn To Speak The Language Of Investment

Kadlubek might be confident when it comes to talking about money now – but when Meow Wolf first met Creative Startups, they didn’t know the difference between debt and equity. They weren’t yet speaking the language of venture capital. That’s why it’s important to speak the language of investors.

“Investors live in a really different culture. They have different norms, they speak a different language. So you need to find people who will bridge the gap for you: people who are ‘two spirits’ and can speak about art and disruption, but also business and investment. Add those people to your advisory board, ask them to make introductions. And go where those investors are.”

Alice Loy

8. Fire People’s FOMO

Getting your timing right is perhaps one of the most elusive parts of the investment puzzle, and one of the hardest to manufacture.

“People want to be part of what’s cool. FOMO is what drove Meow Wolf between $50-60m: the numbers attending their experiences were mind-blowing and these investors’ friends were talking about them at cocktail parties.”

Alice Loy

Perhaps part of this is having the confidence to let this story unfold over time, rather than trying to present the full picture at the beginning. Laura Hess wondered if you should “move fast and break things”, then iterate, or go for a blue-sky version of your product when trying to speak to investors.

“You have to do less than you envisioned. People who give you money aren’t giving you all the money – they’re testing. You want to have that next ask ready for them. To some extent it’s more strategic to unpack money over time.

Over half the people they invest in are going to blow the money – so show that you did what you said you were going to do, rather than thinking of it as one thing you have to do right from the start.”

Alice Loy

The WXO Take-Out

To be successful in raising investment, you have to understand four key things:

- Who you are, what your story is, and how it will resonate.

- Where you are on the risk s-curve, and therefore how you’re likely to be perceived by investors.

- The right kind of investors to target at that moment in time, who are actually likely to give you money.

- The right language to speak, places to go and people to network with in order to unlock their capital.

Getting investment isn’t just about lucky breaks – it’s about being strategic, prepared, and knowing how and where to seek out the opportunities that are relevant for your business, as well as recognising that these will shift depending on where you are in your journey. Just as Meow Wolf were able to move up the investment s-curve over time, so can you.

(Finally: Loy and her team are launching Creative Experience Santa Fe in March 2022, where you can get a headstart on meeting the right people and firms to supercharge your business, as well as other creative companies from across the experience spectrum. Plus! WXO CEO James Wallman will be giving the first IRL Campfire. Click here for more information and to register.)

Want to be part of the most inspiring experience conversations in the world? Apply to become a member of the World Experience Organization here – to come to Campfires, become a better experience designer, and be listed in the WXO Black Book.